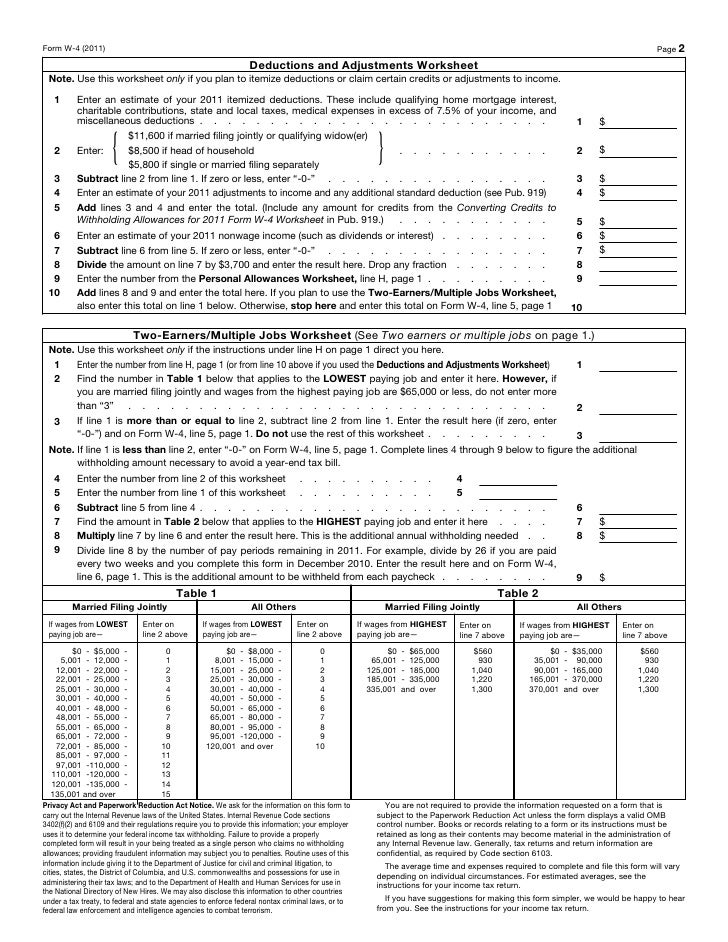

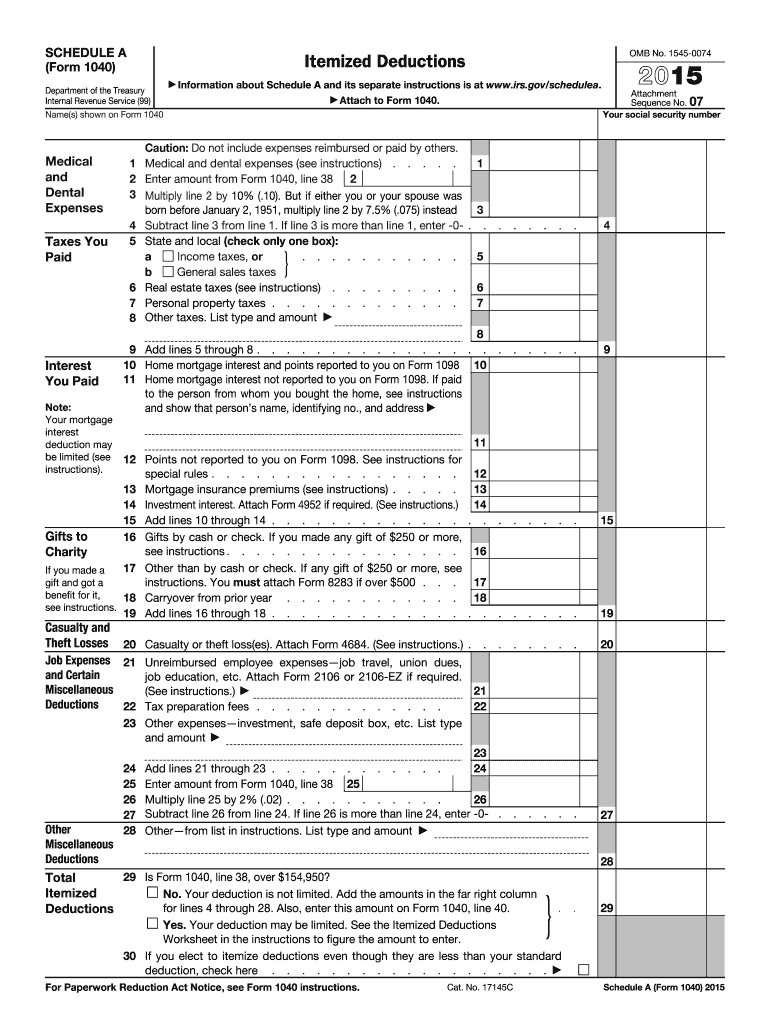

2015 Schedule A Itemized Deductions Worksheet

August 31, 2021Enter here and on Form MO1040 Line 14. Profit or Loss from Business.

Cheat Sheet Of 100 Legal Tax Deductions For Real Estate Agents Real Estate Tips Real Estate Real Estate Agent

Include cost for dependents-do not include any expenses that were reimbursed by insurance Dentists Hospitals Doctors Insurance Equipment Prescriptions Eyeglasses Other Medical Miles _____.

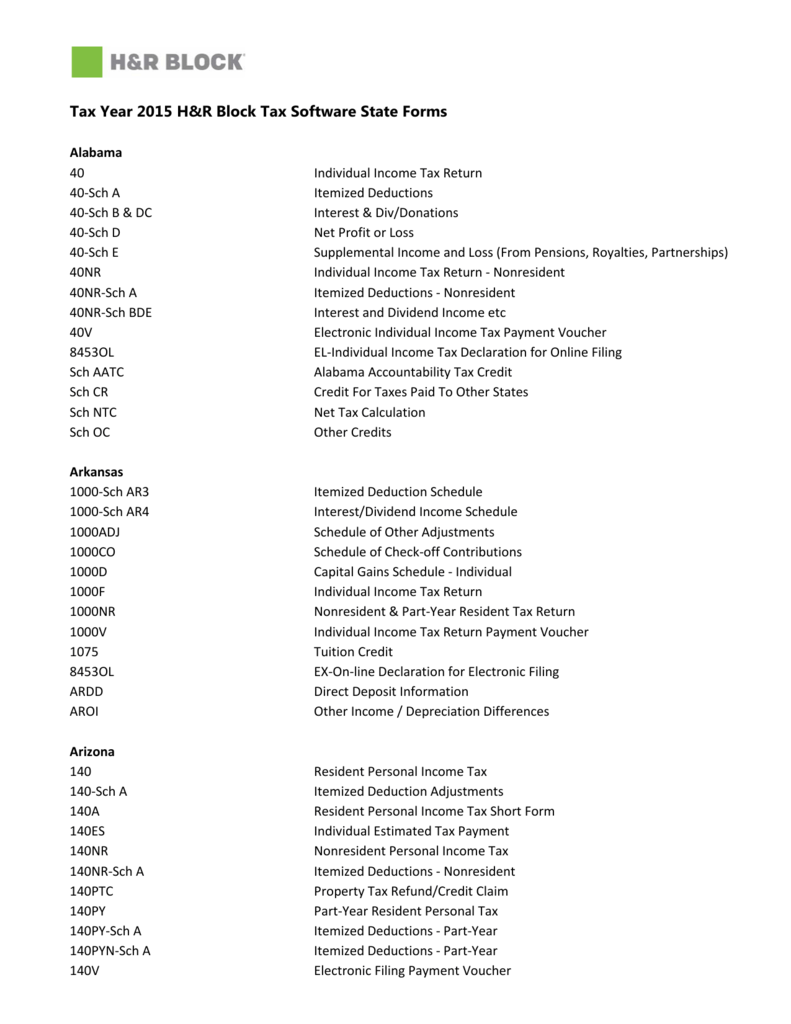

2015 schedule a itemized deductions worksheet. You might benefit from itemizing your deductions on form 1040 schedule a if you. The standard deduction and the total of your itemized deductions each reduce the amount of income on which you must pay federal income tax. Itemized deduction schedule a.

2015 California Adjustments Nonresidents or Part-Year Residents SCHEDULE CA 540NR Important. Enter the first description the amount and Continue. Interest and Ordinary Dividends.

The Standard Mileage Rate for operating expenses of a vehicle for medical reasons is 23 cents per mile. 2015 itemized deductions worksheet for 2015 the standard deduction is 12600 on a joint return 9250 for a head of household and 6300 if you are single. The amounts will be reported on the Schedule KPI KS or KF you received from the entity.

43 44 Enter the larger of the amount on line 43 or your standard deduction listed below. Schedule A - Itemized Deductions continued To enter multiple expenses of a single type click on the small calculator icon beside the line. Medical and Dental Expenses.

2015 Instructions for Schedule A Form 1040Itemized Deductions Use Schedule A Form 1040 to figure your itemized deductions. Must exceed 75 of income to be a benefit. When you use an itemized deduction worksheet 2015 you can make and also customize your customized evaluation in minutes.

If you itemize you can deduct a part of your medical and dental expenses and unre-. Capital Gains and Losses along with its worksheet Schedule E. Line 2 Personal and Dependent.

2015 itemized deductions worksheet for 2015 the standard deduction is 12600 on a joint return 9250 for a head of household and 6300 if you are single. If taxpayer has medical insurance. Some of the worksheets for this concept are Deductions form 1040 itemized Schedule a itemized deductions 2018 schedule a form 1040 Schedule a itemized deductions form 1040 2016 Itemized deduction work 14a 178150 or more Itemized deductions work Itemized deductions limitation work 2015 itemized deductions work.

Miscellaneous itemized deductions in cluding the deduction for unreimbursed job expenses. 2015 itemized deductions worksheet for 2015 the standard deduction is 12600 on a joint return 9250 for a head of household and 6300 if you are single. Itemized deduction worksheet 2015.

Itemized deductions also reduce your taxable income. Enter the information for the next item. Miscellaneous itemized deductions in cluding the deduction for unreimbursed job expenses.

Supplemental Income and Loss. Standard deduction cant be used. Part I Residency Information Complete all lines that apply to you and your spouseRDP for taxable year 2015 During 2015.

Dont forget to include insur ance premiums you paid for medical and dental care. Instructions for Schedule A Form 1040 Itemized Deductions 2015 Form 1040 Schedule A Itemized Deductions 2015 Inst 1040 Schedule A Instructions for Schedule A Form 1040 Itemized Deductions 2014 Form 1040 Schedule A Itemized Deductions 2014 Inst 1040 Schedule A. Your social security number.

Itemized Deductions Worksheet You will need. 12 00 Complete this worksheet only if your federal adjusted gross income from federal Form 1040 Line 37 is more than 309900 if married filing combined or qualifying widower. You might benefit from itemizing your deductions on form 1040 schedule a if you.

The 2015 version of the spreadsheet includes both pages of Form 1040 as well as these supplemental schedules. Attach this schedule behind Long Form 540NR Side 3 as a supporting California schedule. Names as shown on tax return.

2015-Schedule-A-Limit-Worksheet - Itemized Deductions WorksheetLine 29 Keep for Your Records 1 Enter the total of the amounts from Schedule A lines 4 9. Additions Line 1 Itemized Deduction Limitation Complete the worksheet for line 1 on this page if your federal adjusted gross income is more than 184000 92000 if married filing separate and you filed federal Schedule A. Tax information documents Receipts Statements Invoices Vouchers for your own records.

Names shown on Form 1040. MISSOURI ITEMIZED DEDUCTIONS Subtract Line 11 from Line 8. SCHEDULE A Form 1040 Department of the Treasury Internal Revenue Service 99 Itemized Deductions Information about Schedule A and its separate instructions is at wwwirsgovschedulea.

Itemized Deduction Worksheet Medical Expenses. Otherwise reporting total figures on this form indicates your acknowledgement that such figures are accurate and that you vouch for their accuracy as reported on your Federal andor State return. New for Schedule A in 2015.

Attach to Form 1040. You can share and release your customized analysis with others within your firm. They will be totaled on the input line and carried to Schedule A.

Complete the Itemized Deductions Worksheet in the instructions for Schedule CA 540 line 43. Utilizing itemized deduction worksheet 2015 for Excel worksheets can help raise efficiency in your company. In most cases your federal income tax will be less if you take the larger of your itemized deductions or your standard deduction.

Use schedule a form 1040 to figure your itemized deductions. This worksheet is used to report all itemized deductions and a few deductions that do not have to be itemized.

Form 12 12a Five Ways On How To Prepare For Form 12 12a Tax Forms Federal Income Tax Income Tax

What Expenses Can I Claim Free Printable Checklist Of 100 Tax Deductions All About Planners Small Business Tax Business Tax Business Tax Deductions

Pin Oleh Clenoro Suharto Di Tax Pajak

Itemized Deductions Worksheet 2015 Worksheet List

Besoin D Une Alternative A Microsoft Word Et Office Essayez Freeoffice 2016 Deduction Periodic Table

Average Income Tax Preparation Fees Increased In 2015 Tax Prep Income Tax Preparation Tax Preparation

Explore Our Sample Of Itemized Security Deposit Deduction Form For Free Being A Landlord Deposit Deduction

Itemized Deductions Checklist Fill Online Printable Fillable Blank Pdffiller Tax Deductions List Printable Tax Deductions List Tax Deductions

Itemized Deductions Worksheet 2015 Promotiontablecovers

Itemized Deduction Worksheet 2015 Worksheet List

Uber Tax Filing Information Alvia Filing Taxes Rideshare Uber

Schedule C Excel Template Elegant 1040 Spreadsheet With Regard To Schedule C Expenses Math Fact Worksheets Worksheets For Kids Consumer Math

Itemized Deductions Worksheet 2015 Nidecmege

Top View Of Forms For Usa Taxes With A Pen And An Electronic Filing Taxes Tax Extension Tax Deductions

0 comments